Analyses & Studies

French enterprises in China - Q2 Business climate survey

CCI FRANCE CHINE May 2023 Report

French companies in China report tepid economic recovery

With almost 2100 subsidiaries employing some 307400 people, France is the leading European investor in China by the number of companies. With its 1600 members, the French Chamber of Commerce and Industry in China (CCIFC) has been defending the interests of French companies since 1992.

Following up on the series of surveys launched from April 2022, the French Chamber of Commerce and Industry in China (CCIFC) questioned its members between April 24 and May 12 2023 on their activity in the context of the country's reopening. 284 companies responded to the survey.

Read the report of the survey here.

Read the findings of the survey below:

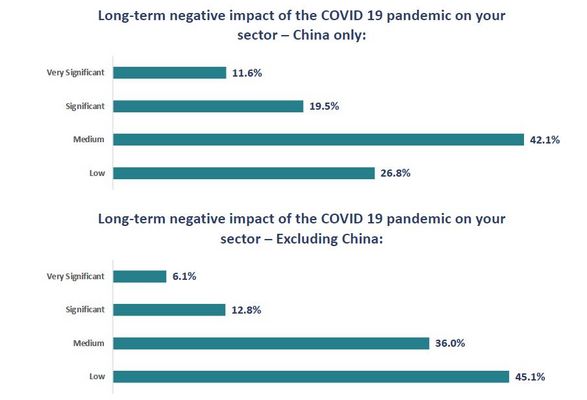

- Despite the lifting of health restrictions, French companies deplore suffering from long-term impacts on their activity. Nearly a third of respondents report a significant impact on their business in China (versus 19% for their activity in the rest of the world); only 27% describe the impact of the pandemic on their business in China as low (against 45% in the rest of the world).

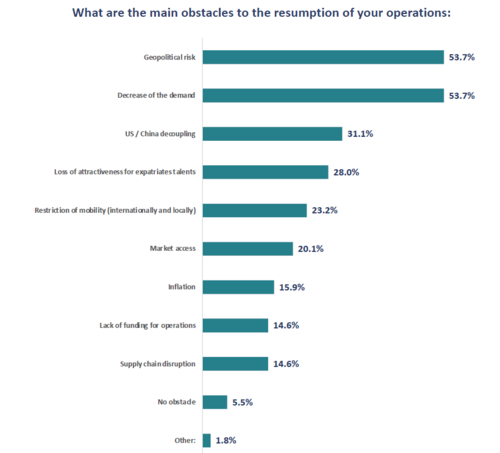

- The main obstacles to their recovery are geopolitical risks (54%), falling demand (54%), Sino-American decoupling (31%), China's declining attractiveness to foreign talent (28%), persistent mobility restrictions (23%), and market access barriers (20%).

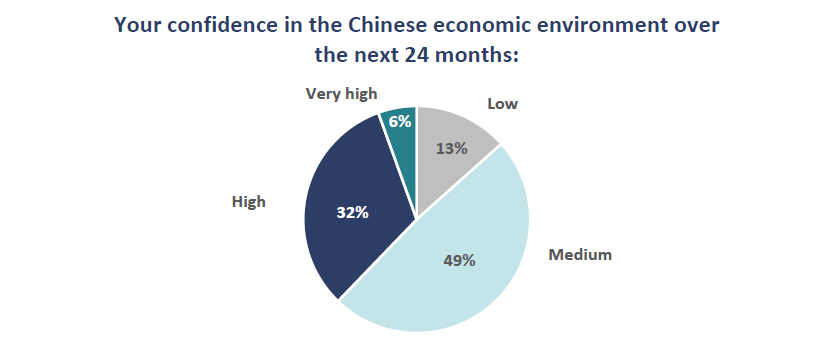

- However, respondents are relatively optimistic regarding China's economic outlook for the next two years. 36% display confidence, compared with 13% who are pessimistic.

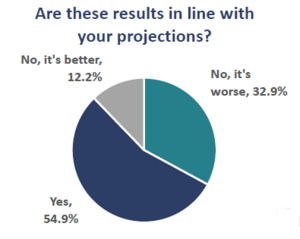

- While more than half of companies reported sales in line with their forecasts for the first four months of 2023, a third of respondents performed below expectations. Only 12% of respondents reported performances exceeding their forecasts.

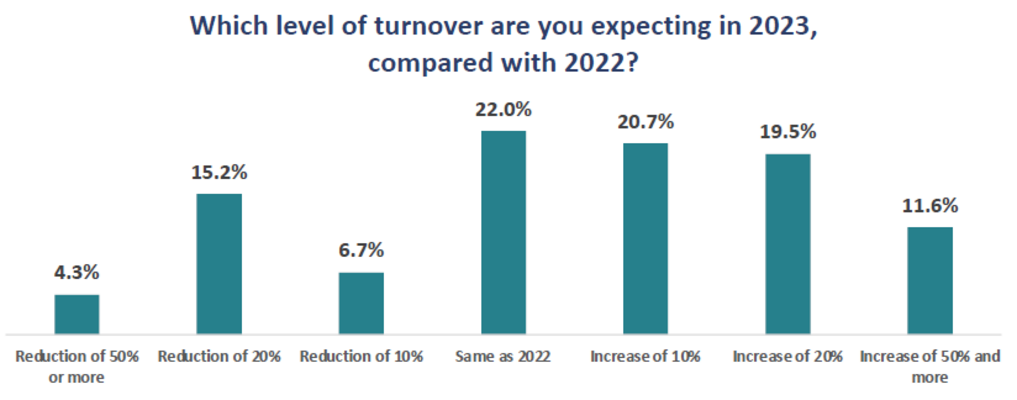

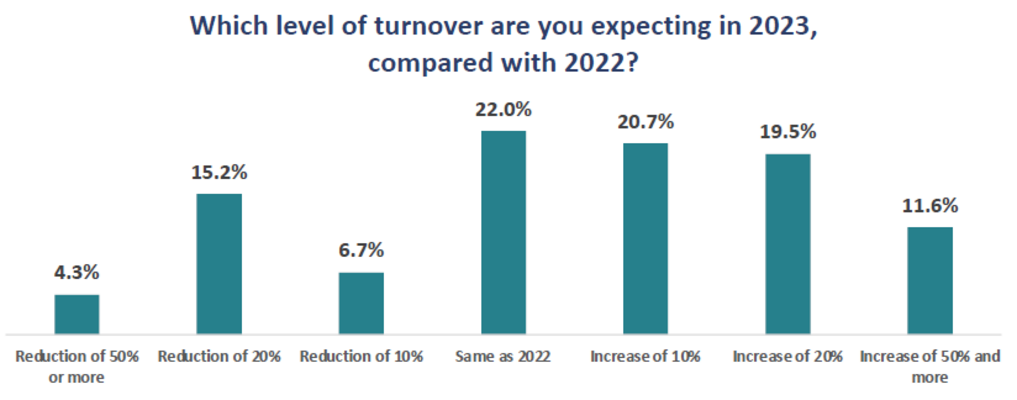

Half of respondents expect their sales to increase in 2023, down from almost two-thirds in the previous survey conducted in February 2023. 22% anticipate sales to remain unchanged, and 26% predict a decrease (versus 14% in the previous survey).

- Broadly speaking, the optimism witnessed at the beginning of the year appears to be fading. The share of companies planning to increase their investments in China is down compared with the previous survey (39% vs. 47% in February). 17% of respondents intend to reduce their presence in China, up from 7% in February, and 16% in September 2022.

- To facilitate the country’s economic recovery, respondents encourage the Chinese authorities to expand the access by foreign companies to subsidies and financial support programs, ensure equal treatment of foreign companies, reduce market access barriers, and implement demand-side

policies.

The survey highlights that French companies continue to face a considerable number of challenges in China despite the lifting of health restrictions at the end of last year. China’s economic recovery remains fragile and falls short of expectations, while structural challenges of doing business in China show no sign of easing. In light of this situation, CCIFC and its members call for foreign companies to be given equal access to financial support programs, and for the establishment of a fair business environment.