[Seminar] New PRC Individual Income Tax Rules and How to Mitigate the Impact to Foreigners - Shenzhen

Event language(s)

Chinese & English

Event ended.

PRC Individual Income Tax (“IIT”) reform is one of the most significant changes over the past 38 years. In March 2019, two most looked-forward to tax circulars were jointly issued by the Ministry of Finance (“MOF”) and the State Administration of Taxation (“SAT”): (1) Public Notice Regarding Criteria for Determining Days of Individuals without Domicile within the Mainland China (“PN 34”); and (2) Public Notice Regarding the IIT Policies for Non-residents and Residents without Domicile (“PN 35”). These two heavy weight Public Notices have systematically consolidated and superseded more than 10 past IIT circulars, and are two of the most important Public Notices issued to date in assembling and smoothing out the implementation of the new IIT law on non-domiciled individuals / expatriates from the tax policies and collection perspectives.

The Association member are cordially invited to join our seminar. We will discuss and share our insights on the following hot topics regarding non-domiciled individuals / expatriates:

- Key points and consideration for determining number of days residing in the PRC and the new "six-year rule"

- Determination of source of employment income, calculation of related taxable income and tax treatment for certain special remuneration items (e.g. annual bonus and equity incentives)

- Changes in and mastering the tax administration requirements

- Deployment and related tax arrangement

- Latest Hong Kong Salaries Tax development and its impact on cross border employees and related tax planning opportunities

We have invited PwC tax experts to share with you their professional analysis and in-depth interpretation of the key changes in and implementation of the above new rules; and guiding you in further reviewing the continuity and validity of your existing policies and arrangement in order to better adapt and plan ahead for the post-IIT reform era.

Time:

Session One (Chinese):

13:30-14:00 Registraton

14:00-15:30 Presentation and Q&A

Session Two (English):

15:30-16:00 Registraton

16:00-17:30 Presentation and Q&A

Fees:

CCI FRANCE CHINE

Members: 100 RMB

Non-members: 200 RMB

Speaker(s)

Scan or hold on the QR Code to register

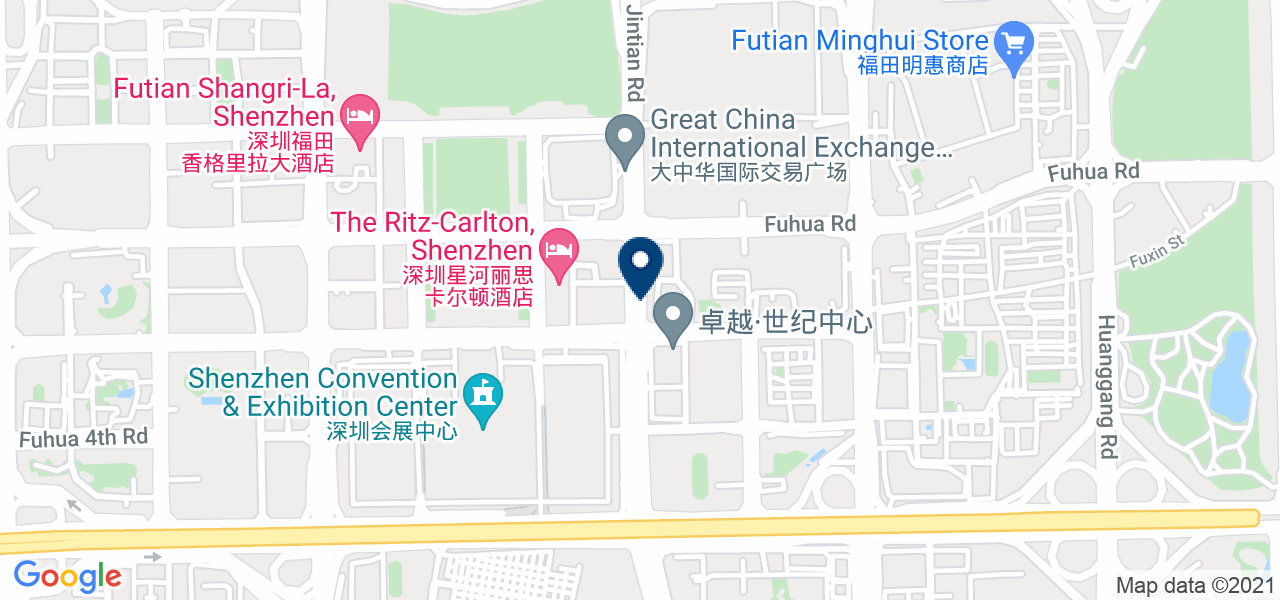

Event Location

[Seminar] New PRC Individual Income Tax Rules and How to Mitigate the Impact to Foreigners - Shenzhen

Event ended.