[EVENT] HR Working Group: Employment management for foreigners and corporate payroll management compliance | 外籍人士雇佣管理以及企业薪酬管理合规

Event language(s)

Chinois 中文

Introduction 活动介绍

提升营商环境、对外开放、鼓励科技创新、支持民营经济是中国新一届政府释放出的强而有力的信号,同时国家移民局于2023年3月15日调整了签证及出入境政策,我们相信很多外国企业在疫情期间暂停的在华投资项目也将陆续重启,来华工作的外籍人士也逐步增多,中国政府对外籍人士的出入境和雇佣提出了新的要求,企业是否已做好准备?我们将为您全面分享外籍人士的雇佣、日常管理及税务相关话题。

全新的税收征管系统“金税四期”于2023年上线,社保系统也将切换至全国统筹系统,面对日趋透明的个税和社保信息披露,我们将为您分享薪酬管理方面的合规事项及最佳实践。

Improving the business environment, opening-up to the outside world, encouraging scientific & technological innovation and supporting the private economy are the strong and powerful signals released by the China’s new government. Are companies ready for the new requirements of entry, exit and employment of expatriates? We'll share with you the issues related to the employment, operation management and taxation of expatriates.

With the Golden Tax System Phase IV and China social security system launching in Year 2023, companies will face more strict information disclosure requirements. Join us to learn how to navigate the challenges, and the best practices in HR & payroll management.

Agenda 活动流程

14:30-15:00 活动签到 Sign In

15:00-15:05 中国法国工商会活动开场 Opening Speech, CCI FRANCE CHINE

15:05-15:45 主题演讲——卓佳中国内地人力资源与薪酬服务副总监彭捷女士 Keynote Presentation by Ms. Susan Peng, Associate Director, HR and Payroll Services, Tricor Mainland China

1. 外籍人士在华雇佣管理 Employment management for foreigners

- 劳动合同签订 Signing of employment contract

- 在华就业程序Employment compliance in China

- 社保缴纳 Social security contribution

- 劳动合同的解除与终止 Termination of employment

- 个人所得税常见税务处理及相关个税优惠政策Common tax treatments and preferential individual income tax policies

2. 企业薪酬管理合规 Payroll compliance management

- 个人信息保护 Protection of employees’ personal information

- 社保全国统筹以及“大库”缴纳社保的风险 National coordinated social security system and the risk of contribution under agent’s account

- 薪酬管理与个税申报合规 Compliance of payroll management and individual income tax reporting

- 金税四期上线所带来的个税监管趋势 Trend of individual income tax supervision followed by the launch of the Golden Tax Phase IV

15:45-16:00 问答环节 Q&A

16:00-17:00 自由讨论

Speaker 主讲嘉宾

Susan Peng 彭捷

Associate Director, HR and Payroll Services, Tricor China

人力资源与薪酬服务副总监,卓佳中国

Susan拥有15年跨国公司薪酬外包及个人所得税税务咨询;专注薪资计算及发放、薪酬筹划、人力资源及社会保障、个人所得税筹划及合规咨询、股权激励计划的外汇及个税税务合规咨询以及外国人在华合规就业、就业证申请等有关政策法规和实践咨询;服务行业涵盖金融投资、保险、IT、法律、传媒、电讯、医药器材、房地产、制造业、奢侈品零售行业等。

Susan Peng has over 15 years of experience in the related fields of payroll outsourcing, individual income tax consulting, etc. She has been focusing on providing payroll and individual income tax services for multinational companies. Services including payroll calculation and payment, compensation arrangements, human resources and social security consulting, individual income tax planning and compliance, compliance consulting on equity incentive plan and its individual income tax, as well as consultation on tax and related compliance policies for foreigners' employment and employment permit applications in China. The industries that Susan served involve fund investment, banking, insurance, IT, law firm, television media, telecommunications, medical equipment, real estate, manufacturing, hotel management and luxury retail, etc.

Registration

Scan the QR code to complete your registration

扫码报名,了解详细信息

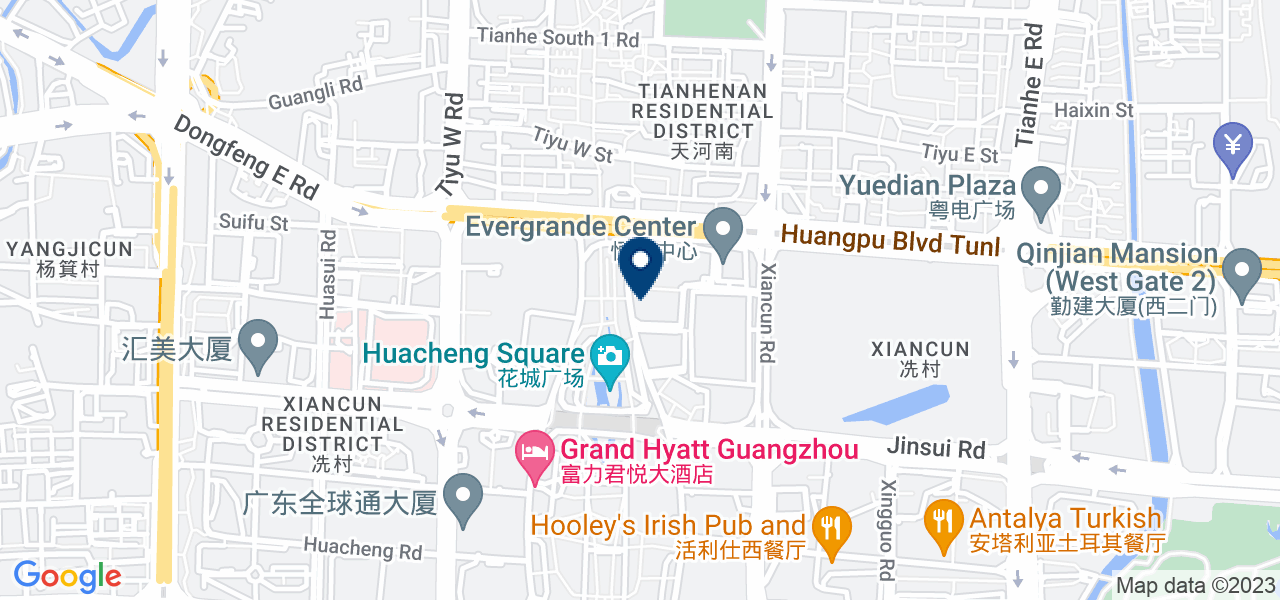

Event Location

[EVENT] HR Working Group: Employment management for foreigners and corporate payroll management compliance | 外籍人士雇佣管理以及企业薪酬管理合规

Event ended.