[Event] Financial and Taxation Policies for Foreign Investment in GBA

Event language(s)

Engliash

Price:

Free and reserved to CCI FRANCE CHINE Members

中国法国工商会会员:免费

本次活动仅对会员企业开放

Event Outline

Current status of foreign investment in China

Foreign investment grew steadily, and foreign investment hit historical high in 2022. To attract foreign investment, the government has provided legal and policy support to attract foreign investment.

Taxation regulations and preferential policies

Tax compliance is critical to company’s operation. Besides standard tax rate, there are favorable tax policies, including:

- VAT: Small-scale VAT payer, additional VAT deduction for service industry, exemption for overseas service income

- Corporate income tax: favorable tax rate for small enterprise with low profit, high and new technology company, and Guangzhou Nansha preferential tax rate of 15%

- Individual income tax: Special deduction item for foreigners, IIT subsidies to foreign talents in Greater Bay Area, tax exemption of dividend to foreign individuals

Dividend transfer policies

Certain procedures should be met when transferring profit overseas. We will illustrate the process and documents for profit transfer and tax issues related to dividend transferred aboard.

Government rewards

To attract high-quality investment, Guangzhou Government provides exclusive rewards to foreign companies, especially manufacturing companies. In addition, companies in advance manufacturing, modern service, IT and other high-technology industries are entitled to incentive funds

Speaker

Alison Liu

Financial Expert Over 13 years’ experience CPA, CMA, experience in audit, tax and FP&A in multinational companies

Registration

Please scan the blew QR code to complete your registration

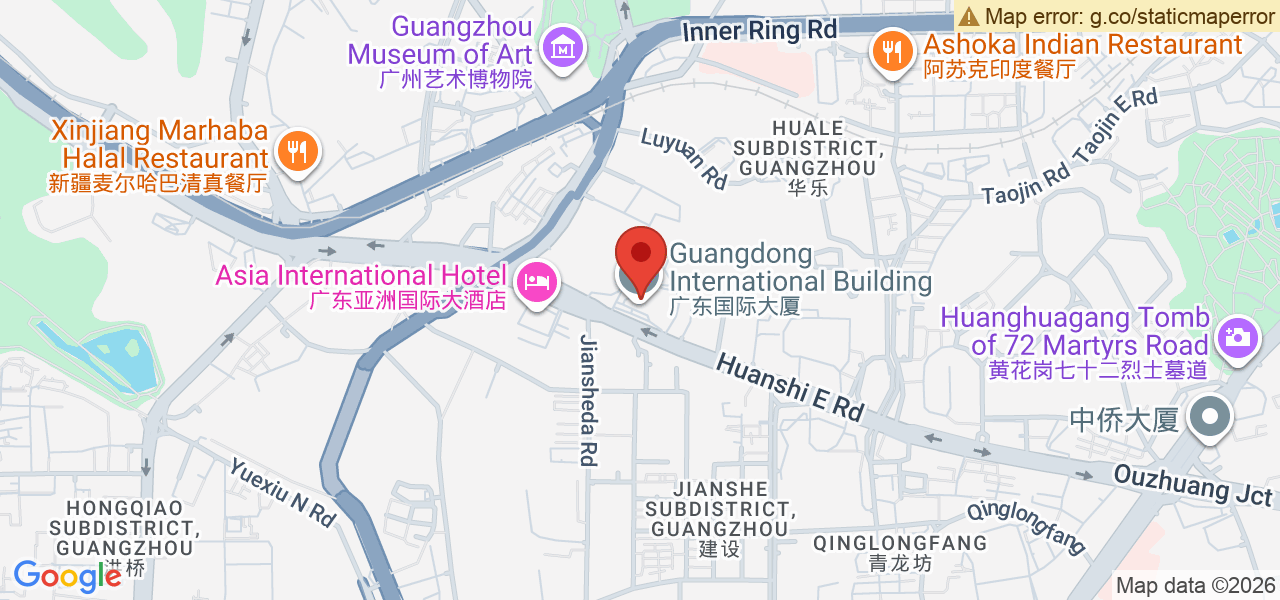

Event Location